Whisky Cask Cost and Yield Calculator

Bottling is one of several routes available to a whisky cask owner once maturation is complete. Rather than selling the cask in bond, the owner chooses to bottle the whisky, releasing it from cask form into finished bottles ready for sale, gifting, or long-term holding.

The decision to bottle is both technical and commercial. It involves reducing the whisky to a chosen strength if required, calculating expected bottle yield, and accounting for costs such as bottling, duty, VAT, labelling, packaging, and logistics. Small changes in alcohol strength, bottle size, or remaining bulk litres can materially affect the final outturn and overall economics.

Whether you’re exploring whisky cask ownership for the first time, comparing multiple casks before you buy, or estimating costs for a cask you already hold, understanding how these variables add up is important. This calculator helps you break down the real numbers behind cask price, UK VAT and Duty, volume and strength, the number of bottles a cask may yield, and the costs involved in bottling.

By entering a cask price, the liquid volume in litres, and the current alcohol by volume (ABV), you can see which factors matter most when planning or valuing a cask. The tool allows you to model dilution choices, sense-check expected bottle yield, and understand how bottling decisions influence the final outcome.

This calculator is designed as a practical planning aid, not a forecast. It an estimator intended to help you build a clearer picture before committing to sourcing, storage, or bottling decisions, and should be used alongside professional and regulatory guidance where appropriate.

Want to discuss further?

Contact us today

If you'd like to discuss bottling your whisky cask further, please do drop us a line - we'd be delighted to help. If you want to buy a whisky cask, or sell one, we can also help with that too.

Need help understanding cask calculations?

Frequently Asked Questions

Taxes

You don't have to pay taxes when you first buy your whisky cask, assuming you're keeping it in duty suspension.

You don't have to pay taxes while you hold and age your whisky, as long as it remains under duty suspension in a Bonded Warehouse.

You do have to pay taxes when the cask is bottled. The two relevant taxes are VAT and Duty.

VAT is due on: the original purchase price of the cask; the duty paid on the alcohol; and on associated services (eg bottling) and dry goods (eg glass bottles). The calculator above splits out VAT for the first two points, this is for transparency. VAT on other services and dry goods are included within the figures themselves rather than split out separately, this is for simplicity.

When you bottle your whisky cask, you'll need to pay two key taxes: VAT (UK sales tax) and Alcohol Duty.

VAT is due on: the original purchase price of the cask; the duty paid on the alcohol; and on associated services (eg bottling) and dry goods (eg glass bottles). The calculator above splits out VAT for the first two points, this is for transparency. VAT on other services and dry goods are included within the figures themselves rather than split out separately, this is for simplicity.

Alcohol duty is due on the bulk litres of pure alcohol. As above, don't forget the VAT associated with this sum - in a quirk of the UK tax system, VAT tax is due on top of Duty tax.

It's important to remember that tax rates can change over time. The UK Government has a tendency to focus on alcohol during their Budgets.

As of January 2026, VAT is 20% and alcohol duty for Spirits over 22% ABV (which, by definition, includes whisky) is £32.79 per litre of pure alcohol.

The calculator above estimates duty at a headline, or bulk, level. As a point of additional context, it is worth noting that the higher the bottling strength, the more duty would be payable per individual bottle.

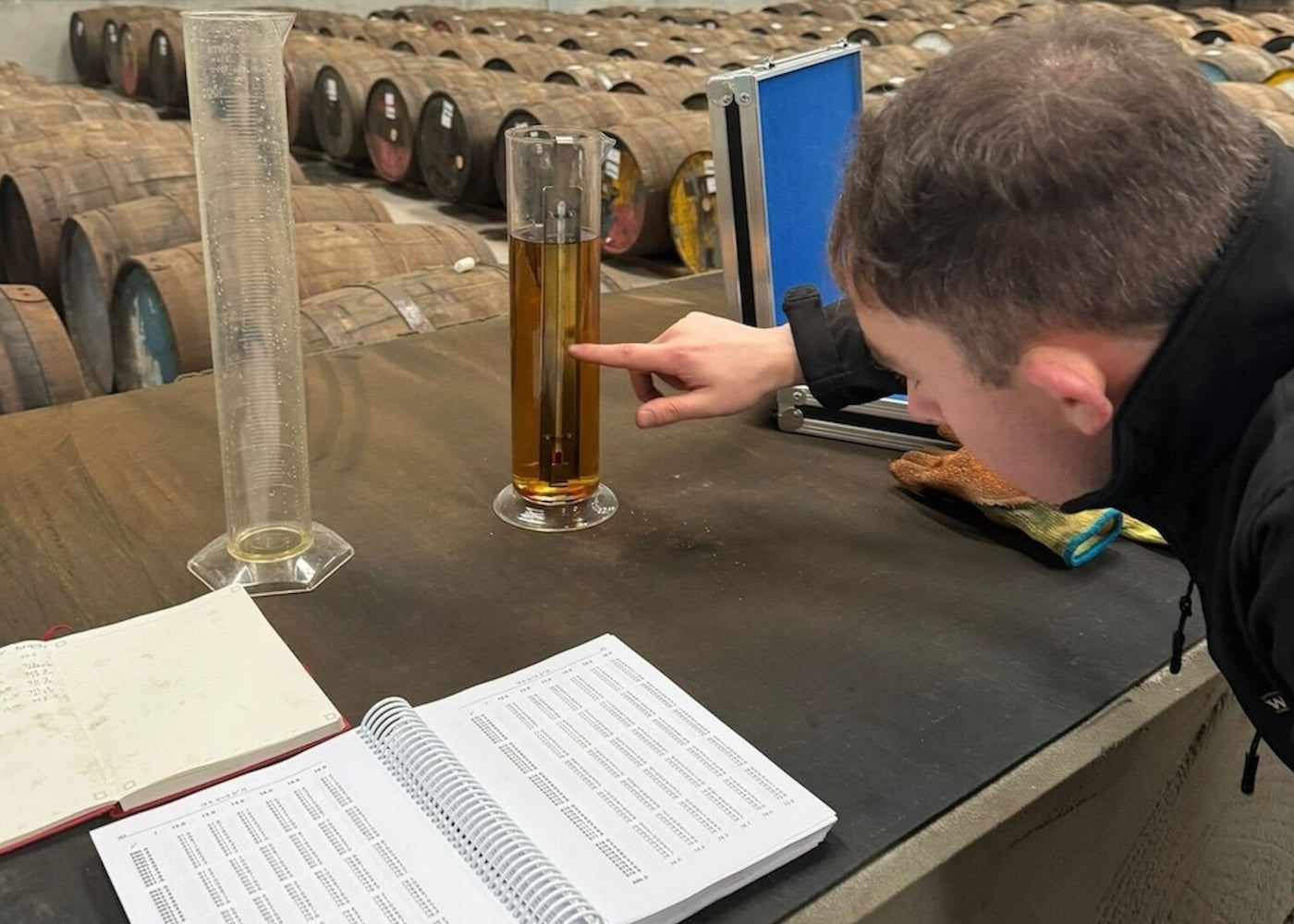

Cask yield

Whisky ages in a cask for a number of years; at a legal minimum, three years, but often many more. Each year, a small amount of whisky evaporates; this is known as the "angel's share". The exact amount that evaporates varies depending on a number of factors, but a typical figure might be 1-3% per year. The longer the whisky ages, and the more whisky that evaporates, the less is available to bottle - reducing the cask yield.

The legal minimum bottling strength for whisky in the UK is 40% alcohol by volume (ABV). The maximum potential bottling strength is the natural strength of your whisky in the cask, before any water is added - known as bottling at 'cask strength'.

Many single cask, artisan whiskies are bottled at natural cask strength. This shows the whisky in its most original form. And allows the drinker to choose how much water to add, or not add, as they wish.

However, you can choose to add water during the bottling stage, if you wish. You may choose to do this if natural cask strength is exceptionally - too - strong (for example, in the 60s). Or, you might do this as you feel the whisky presents better at a reduced strength - often known as the 'ideal strength'. Or, you may choose to add water to increase yield and therefore reduce the cost of individual bottles (adding water increases the volume you have available to bottle).

Beyond natural cask strength, common bottling strengths for artisan whiskies including: 46%, 48% and 50%.

The most common size of whisky bottle in the UK, and indeed in Europe, is 700ml (0.7 litres).

Spirits bottle sizes, including whisky, are regulated. Other permissible sizes are: 100ml, 200ml, 350ml, 500ml, 1000ml, 1500ml, 1750ml, 2000ml. Most of these are seldom used for single cask whisky. The two you might come across are 500ml (for more expensive whiskies) and 1000ml (but this is rarer).

Sticking with the default of 700ml is the most straightforward option.

Bottling costs

Dry goods is the collective term for the things you'll need to bottle your whisky, beyond the liquid itself.

Dry goods you'll definitely need include:

- Bottle

- Stopper

- Capsule (covers the stopper at the top of the bottle)

- Front label

- Shipping case (one case usually fits six bottles)

Optional dry goods you may want to use (but which are not factored into the calculator above) include:

- Back label (if you want to include more details)

- Presentation box (these can be pricey depending on specification, but can suit premium whiskies or gifting)

It adds some cost and complexity, but absolutely, you can certainly send to multiple addresses.

Depending on the number of addresses you wish to send to, you may need to consider sending to a fulfilment centre who could help you co-ordinate delivery of large numbers of individual bottles to separate addresses.

We've assumed one UK mainland delivery address in our calculations. If you have other needs, we recommend contacting us.

Our calculator is based on a UK address. But it is possible to send to international addresses.

This could have implications on the Alcohol Duty and VAT due in the UK - and on the taxes due in the receiving country.

Specific licences may be required, depending on the receiving country's laws and regulations.

Costs will vary depending on location and transport method (for example, shipping by air is fast but expensive, shipping by sea is slow but more cost effective).

Bottle Pricing

Yes, you will need the relevant licences to sell alcohol in the UK. Licensing requirements vary depending on whether you're selling to individual private customers, or wholesaling into businesses. You may also need a licence to store alcohol prior to sale, depending on your warehousing solution.

As licensing is a very important topic (fines and prison sentences can apply if licence conditions are not met), we will keep our answer here purposefully brief and recommend you do thorough research - starting with the Government's guidance.

The calculator above is aimed at private UK individuals who want to better understand the costs involved in bottling whisky casks. As such, the figures in the calculator are the underlying costs to bottle a cask - and don't include any type of margin.

For broader context, the whisky industry would usually consider two layers of profit margin: a wholesale margin (the amount a manufacturer makes when they sell to an intermediary business) and a retail margin (the amount an intermediary business makes when selling to an end customer). Where a manufacturer sells direct to an end customer, they would keep both elements of the margin (ie wholesale and retail).

Yes, bottling your cask is just one of a number of exit opportunities. While it's perfect if you want the whisky yourself, there are other options that may, ultimately, prove simpler and more economical if you simply wish to realise a return on your investment. Please contact us, we'd be pleased to help further.

Further reading

Articles you may enjoy

The “Exit” Strategy: how to sell a whisky cask

Learn how to sell a whisky cask, when whisky investment returns peak, and how bottling, brokers, and buyers affect liquidity.

Read more

Mythical Beasts The Phoenix crowned Scotch Grain of the Year

Awarded Scotch Grain of the Year in Jim Murray’s Whisky Bible 2025–2026, this 24-year-old Port Dundas grain whisky is PX sherry finished and limited to 226 bottles.

Read more

The Chemistry of the Whisky Cask

Discover how wooden casks shape up to 70% of a whisky’s value, from first-fill vs refill to sherry and bourbon cask chemistry.

Read more